40 is service revenue an asset

What is service revenue in accounting? - Quora Answer (1 of 3): A service company is a business that generates income by providing services instead of selling physical products. A good example of a service company is a public accounting firm. They earn revenues by preparing income tax returns, performing audit and asset services, and even doi... OneClass: is service revenue an asset Get the detailed answer: is service revenue an asset. 🏷️ LIMITED TIME OFFER: GET 20% OFF GRADE+ YEARLY SUBSCRIPTION →

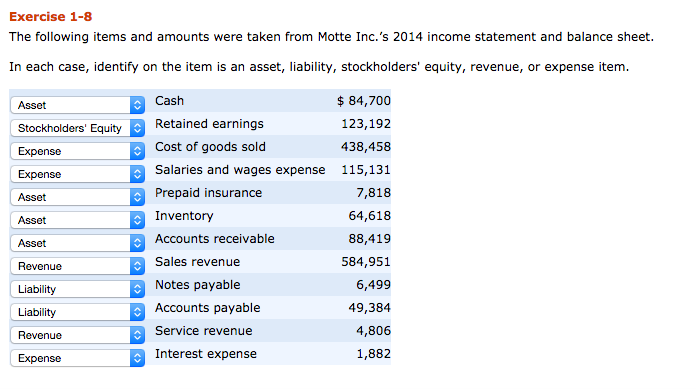

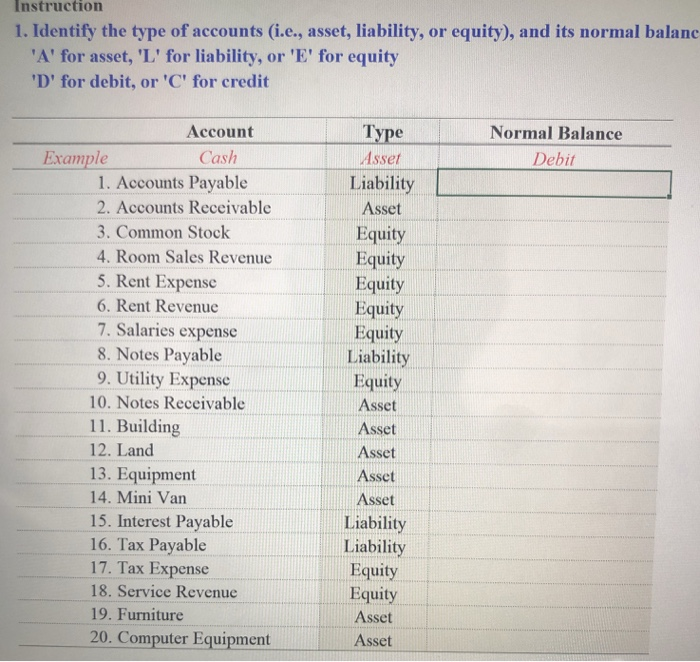

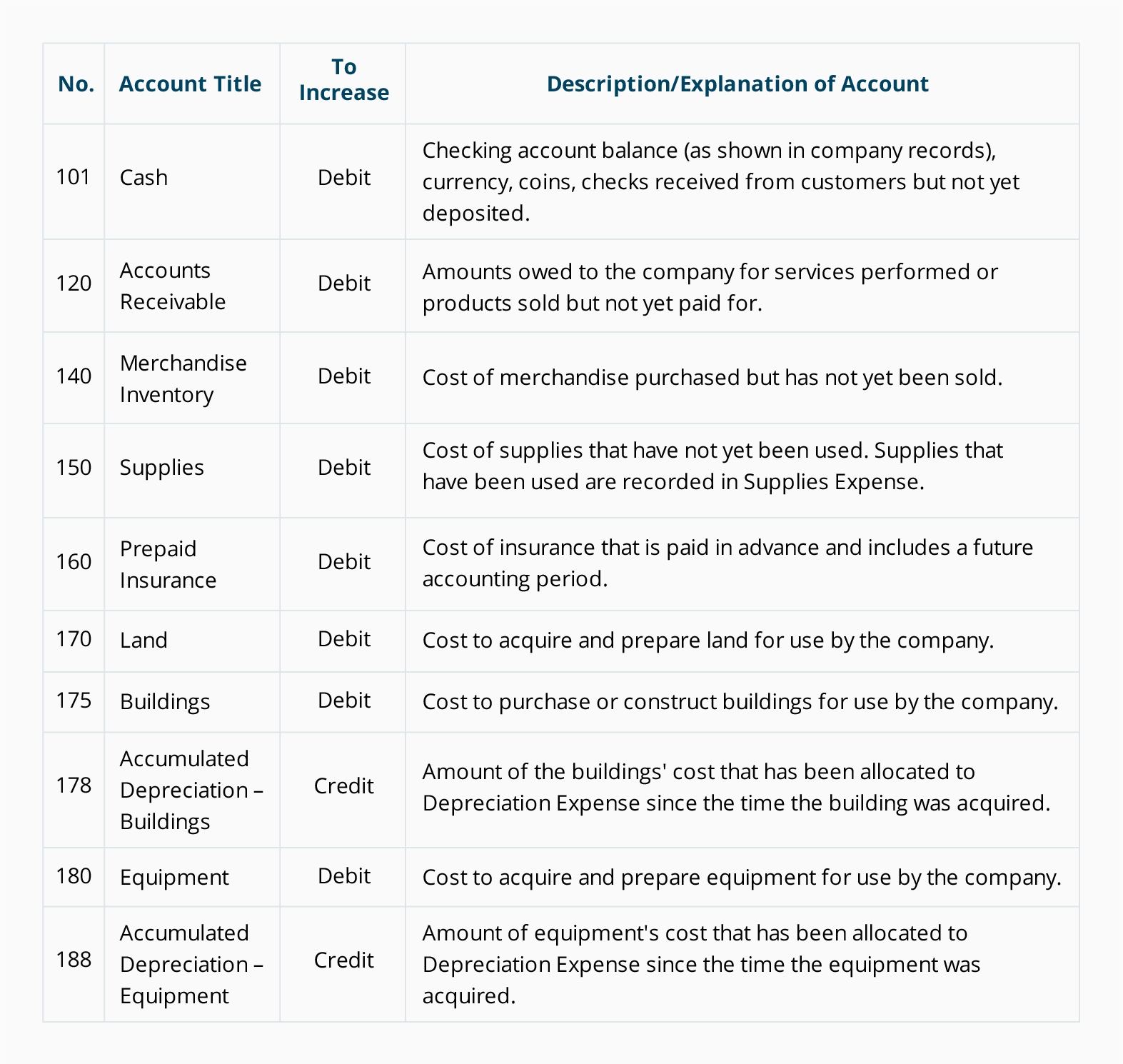

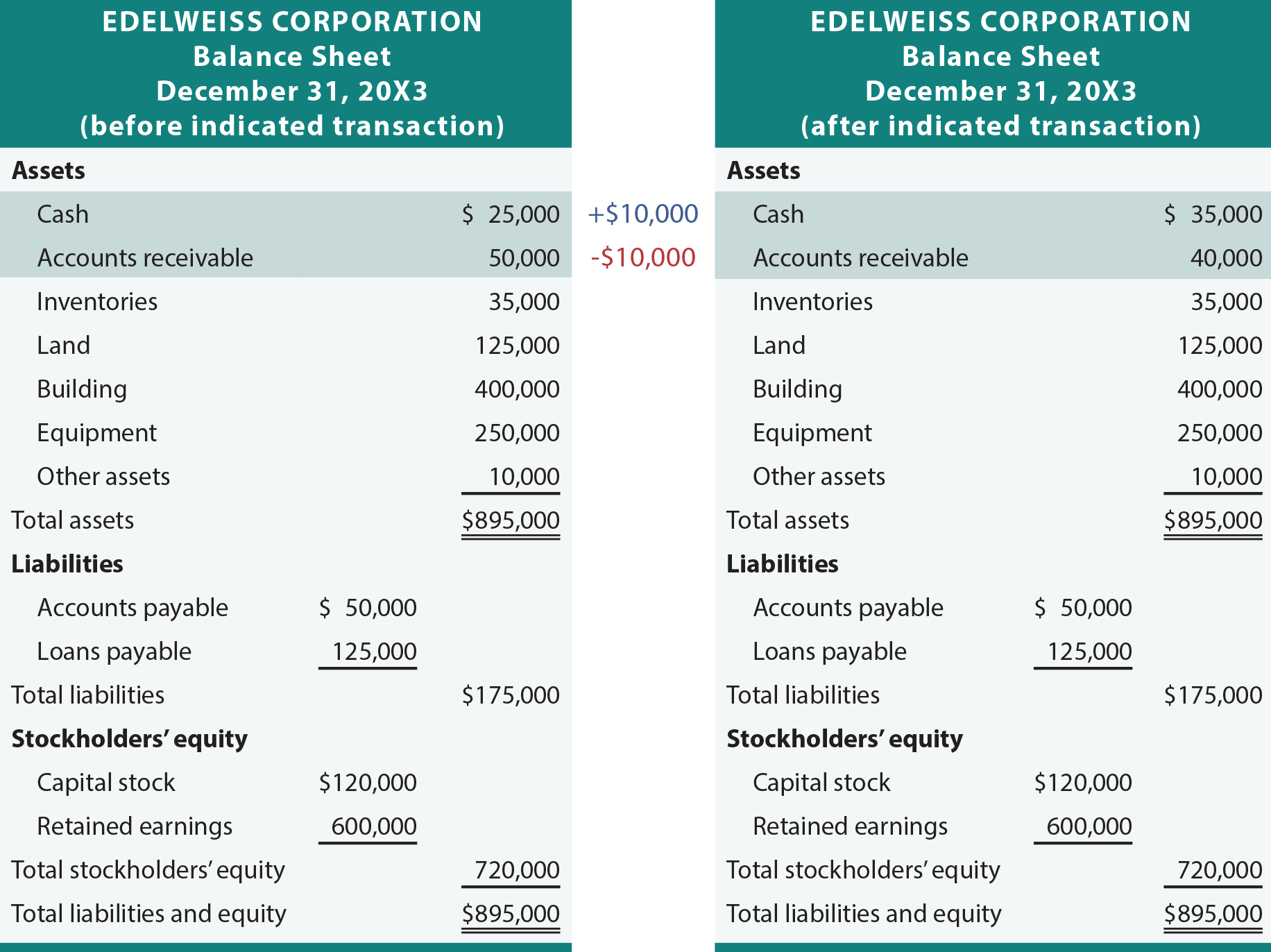

Accounting Basics: Assets, Liabilities, Equity, Revenue ... Assets. Assets can be defined as objects or entities, whether tangible or intangible, that the company owns that have economic value.Tangible assets are physical entities that the business owns such as land, buildings, vehicles, equipment, and inventory. While Intangible assets are things that represent money or value, e.g. Accounts Receivables, patents, contracts, and certificates of deposit ...

Is service revenue an asset

Internal Revenue Bulletin: 2006-31 | Internal Revenue Service 31.7.2006 · The Internal Revenue Service and the Department of the Treasury are currently revising Form 656, Offer in Compromise, and developing regulations under section 7122 of the Internal Revenue Code to implement the amendments to section 7122 made by section 509 of the Tax Increase Prevention and Reconciliation Act of 2005 (“TIPRA”), Pub. L. No. 109-222. Is service fees a revenue? - FindAnyAnswer.com Service Revenue is income a company receives for performing a requested activity. The charges for such revenue are recorded under the accrual method of accounting. This means all fees for services performed to date can be included in an income statement, even if not all the bills have been sent out to clients yet. Click to see full answer Unearned Revenue - Definition, Accounting Treatment, Example Unearned revenue, sometimes referred to as deferred revenue Deferred Revenue Deferred revenue is generated when a company receives payment for goods and/or services that it has not yet earned. In accrual accounting, , is payment received by a company from a customer for products or services that will be delivered at some point in the future.

Is service revenue an asset. Is Service Revenue a Current Asset? | Finance Strategists No, service revenue is not a current asset for accounting purposes. A current asset is any asset that will provide an economic value for or within one year. Service revenue refers to revenue a company earns from performing a service. › terms › aAsset Definition - Investopedia Jan 27, 2022 · Asset: An asset is a resource with economic value that an individual, corporation or country owns or controls with the expectation that it will provide future benefit. Assets are reported on a ... What Type of Account Is Unearned Revenue? - Deskera Blog Prepayments are recorded as a credit to Unearned Revenue and a debit to the Cash account. Then, once the order or service is completed, an adjusting entry is made which debits Unearned Revenue and credits Service Revenue (or Sales Revenue). To understand what that means, let's take a look at an example: Cloud Field Service and Asset Management System | KloudGin Smarter Assets. Smarter Workers. KloudGin is the only combined, one-cloud Field Service and Asset Management solution on a single, easy-to-use platform

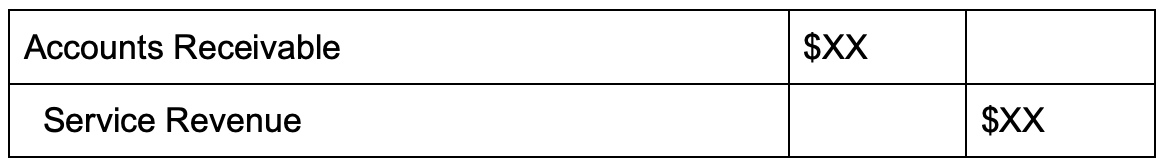

Is service revenue an asset or liability? - Answers Is service revenue an asset or liability? - Answers Services revenue is revenue same as product revenue and it is not an asset or liability of the business. Home Study Guides Science Math and... › is-service-revenue-an-assetIs Service Revenue an Asset? Breaking down the Income Statement Is Service Revenue an Asset? Breaking down the Income Statement Hub Accounting Service revenue is the income a company generates from providing a service. The amount is displayed at the top of an income statement and is added to the revenue from product earnings to show a company's total revenue during a specific time period. Unearned Revenue Definition Unearned revenue is money received by an individual or company for a service or product that has yet to be provided or delivered. It can be thought of as a "prepayment" for goods or services that ... Service Revenue - Definition and Explanation Service revenues can arise from rendering services for cash or on account (on credit) to be collected at a later date. The journal entry for services rendered for cash is to debit Cash and credit Service Revenue. Cash is an asset account hence it is increased by debiting it. Service Revenue is a revenue account; it is increased by crediting it.

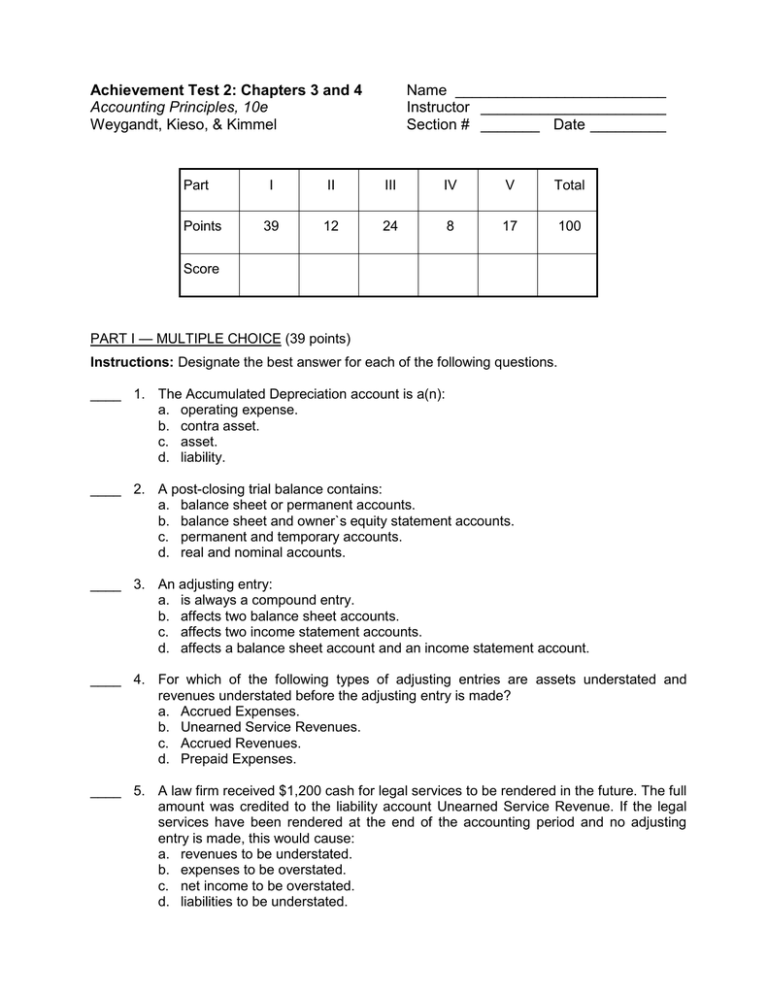

Is service revenue an asset? | Study.com Service revenue is not an asset, but a revenue or income account. The five types of account classifications are: assets, which are items that a... See full answer below. Become a member and unlock... › publications › p946Publication 946 (2020), How To Depreciate Property | Internal ... Section 179 deduction dollar limits. For tax years beginning in 2021, the maximum section 179 expense deduction is $1,050,000. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $2,620,000.Also, the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021 is $26,200. Solved choose the correct answer #1:- Service | Chegg.com Question: choose the correct answer #1:- Service Revenue:- [_] Balance sheet and asset account [_] Balance sheet and liability account [_] Balance sheet and owners' equity account [_] Income statement account [_] Statement of retained earnings account #2:- Accumulated depreciation:- [_] Balance sheet and asset account [_] Balance sheet and ... Sale of a Business | Internal Revenue Service May 28, 2021 · For more information, see Internal Revenue Code section 332 and its regulations. Allocation of consideration paid for a business. The sale of a trade or business for a lump sum is considered a sale of each individual asset rather than of a single asset.

Account Types - principlesofaccounting.com This cookie is used to track how many times users see a particular advert which helps in measuring the success of the campaign and calculate the revenue generated by the campaign. These cookies can only be read from the domain that it is set on so it will not track any data while browsing through another sites.

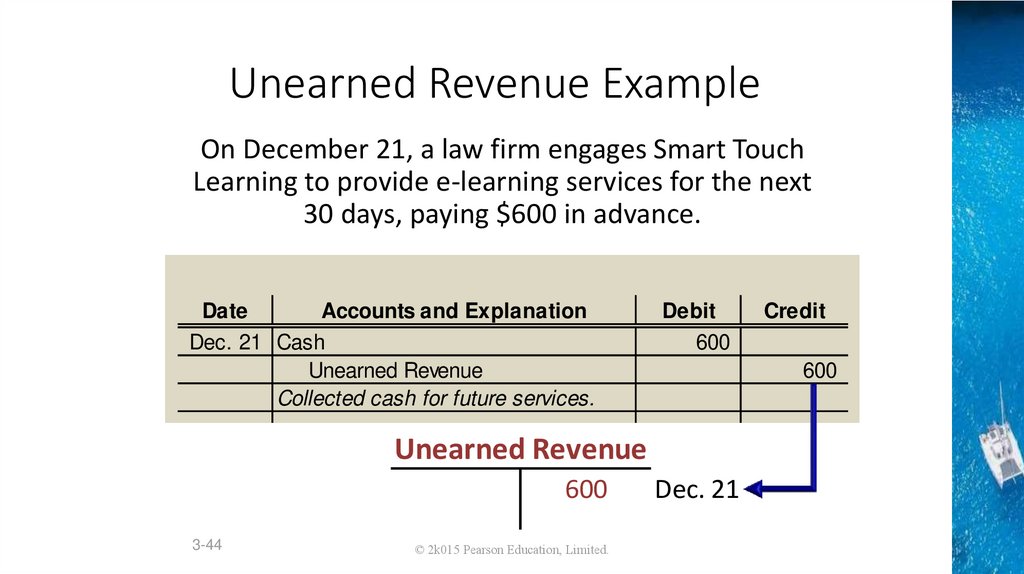

Solved The Unearned Service Revenue account is a(n ... The Unearned Service Revenue account is a(n) asset. revenue. expense. liability. Question: The Unearned Service Revenue account is a(n) asset. revenue. expense. liability. This problem has been solved! See the answer See the answer See the answer done loading. The Unearned Service Revenue account is a(n) ...

Is Unearned Revenue an Asset or Liability? - Wikiaccounting Unearned revenue is the cash proceeds received by a company or individual for a service or product that the company or individual still has to deliver to the customer. It is an advance payment from a customer that is expecting the delivery of services or products at a later date.

› industries › oil-gasOil, Gas, and Energy | Industry Software | SAP Production and revenue accounting with upstream hydrocarbon accounting and management Visual user interface with interactive functionality for supply chain management Asset monitoring, based on granular data from sensors and maintenance history

Internal Revenue Service - United States Secretary of the ... Oct 03, 2010 · The Internal Revenue Service (IRS) is responsible for the determination, assessment, and collection of internal revenue in the United States. This revenue consists of personal and corporate income taxes, excise, estate, and gift taxes, as well as employment taxes for the nation s Social Security system.

Is Service Revenue an Asset? - FundsNet Service revenue is an income statement account and as such, would typically appear in a business's income statement. From this alone, we can conclude that service revenue is not an asset. Service revenue normally has a credit balance Another characteristic of an asset that cannot be found on service revenue is that it normally has a debit balance.

Is Service Revenue an Asset? - Deskera Blog No, service revenue is not an asset. Assets are defined as resources with economic value that a business owns. Whereas service revenue is a business' earnings from providing goods and services to its customers. So, service revenue is considered a revenue (or income) account and not an asset.

Details for Service Revenue Asset Or Equity and Related ... Service revenue refers to revenue a company earns from performing a service. For accounting purposes, revenue is recorded on the income statement rather than on the balance sheet with other assets. Revenue is used to invest in other assets, pay off liabilities, and pay dividends to shareholders. Therefore, revenue itself is not an asset. More ›

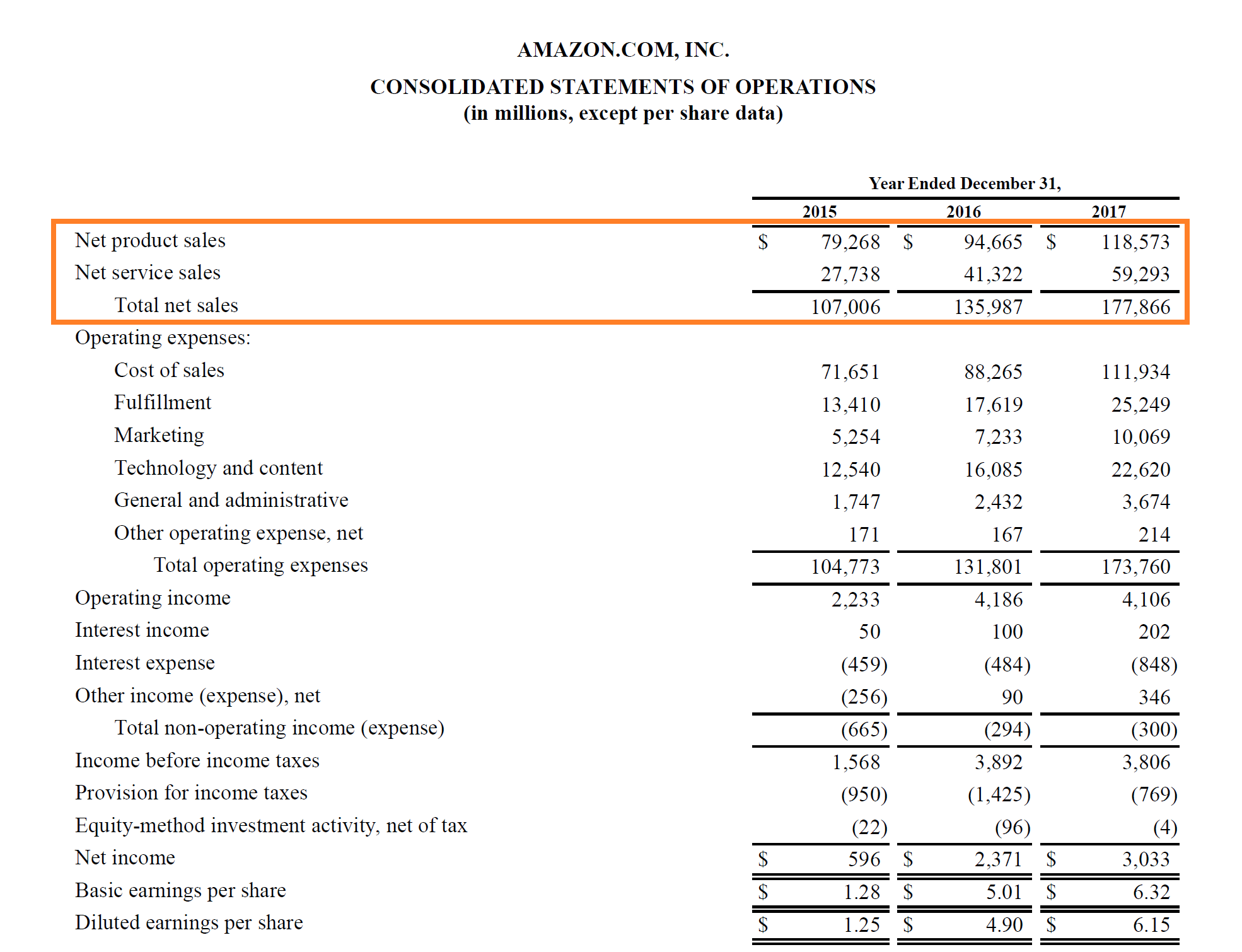

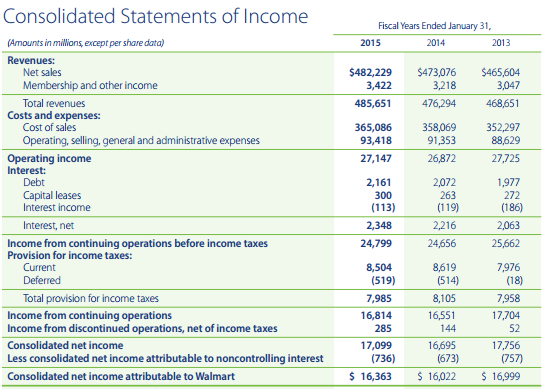

Is Service Revenue an Asset? Breaking down the Income ... Is Service Revenue an Asset? Breaking down the Income Statement The income a company earns from providing a service is referred to as service revenue. The amount is shown at the top of an income statement and is added to product earnings revenue to show a company's total revenue for a given time period.

Is Service Revenue Asset or Liability + How to Calculate It Is service revenue a current asset? Service revenue is a type of income that an organization earns from rendering a service. The accounting equation states that assets equal liabilities plus equity, so if the company's net asset figure is positive, it means they have more current assets than current liabilities.

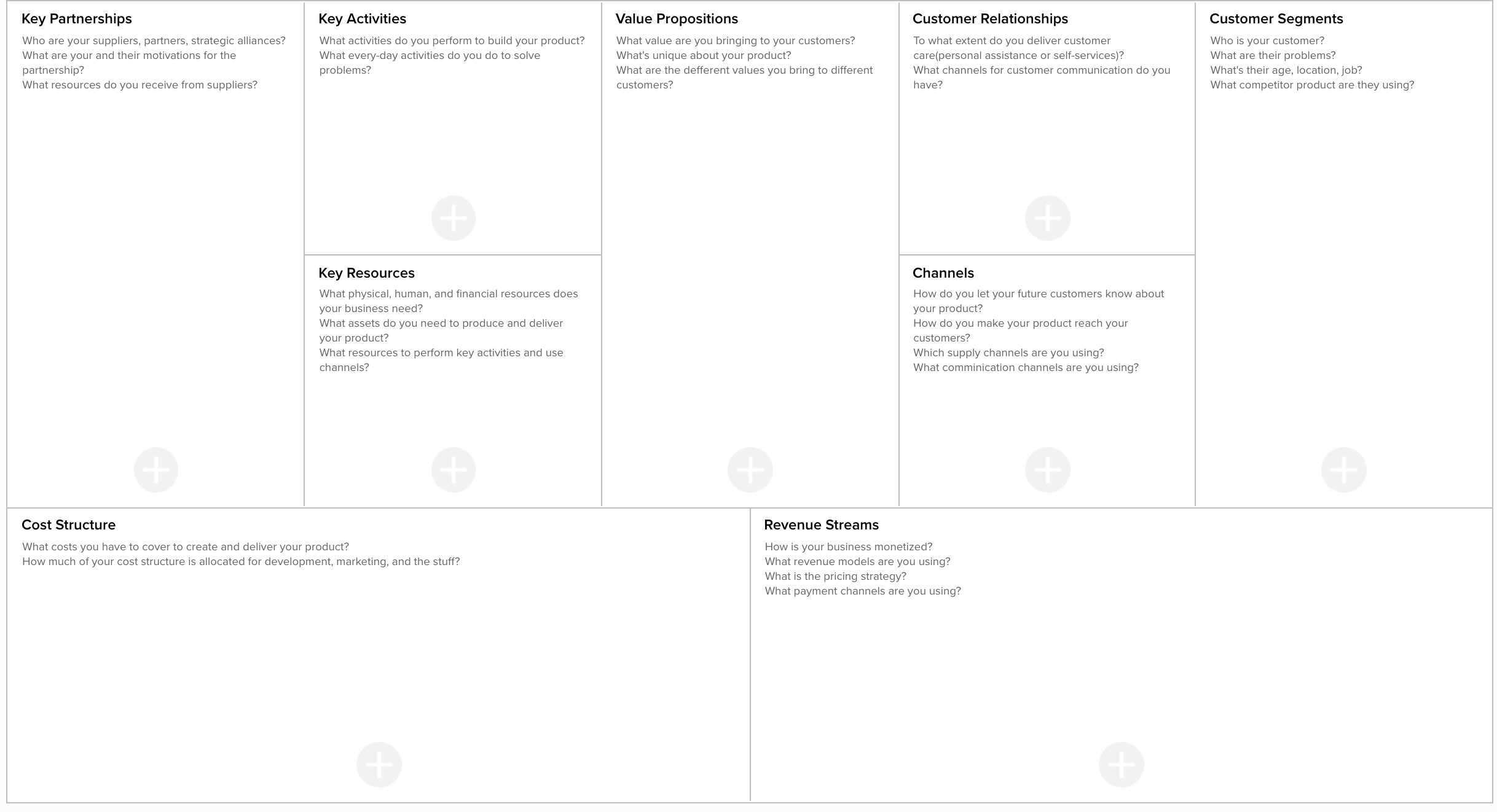

Revenue stream - Wikipedia This revenue stream belongs to the recurring revenue model. Lending / leasing / renting. This sort of revenue is made by giving someone access to an asset, which can be a product or a service. The key difference to a subscription fee is that this asset still belongs to the company. Common examples include car rentals or hardware leasing.

› terms › rRevenue Definition Aug 22, 2021 · Quarterly Services Survey: A survey produced quarterly by the Census Bureau that provides estimates of total operating revenue and percentage of revenue by customer class for communication-, key ...

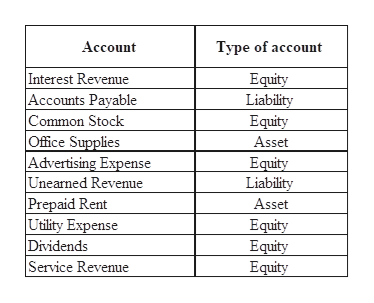

Accounting Unit 1 Flashcards - Quizlet Asset 4. Service Revenue Equity 5. Prepaid Insurance Asset 6. Accounts Payable Liability 7. Unearned Revenue Liability 8. Notes Receivable Asset 9. Brock, Withdrawals Equity 10. Insurance Expense Equity. Consider the following accounts and identify each as an asset (A), liability (L), or equity (E). 1. Rent Expense

Is Service Revenue an Asset? - Skynova.com Nonetheless, for financial accounting purposes, service revenue is not considered an asset. In accounting definitions, a current asset (like accounts receivable) is any asset that will provide an economic value for or within one year. For accounting purposes, revenue is recorded on the income statement rather than on a balance sheet.

Asset Turnover Ratio Definition: Formula & Examples Asset turnover ratio measures the value of a company's sales or revenues generated relative to the value of its assets. The Asset Turnover ratio can often be used as an indicator of the ...

What Are the Differences Between Assets and Revenue? | The ... Revenue is tangentially related to an asset. If Wal-Mart sells a prescription to a customer for $50, it might not receive the payment from the insurance company until one month later. However, it...

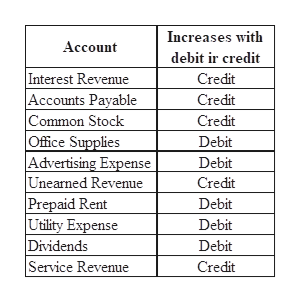

What Is Unearned Revenue? A Definition and Examples for ... When the business provides the good or service, the unearned revenue account is decreased with a debit and the revenue account is increased with a credit. If a business entered unearned revenue as an asset instead of a liability, then its total profit would be overstated in this accounting period.

Service revenue definition - AccountingTools Service revenue is the sales reported by a business that relate to services provided to its customers. This revenue has usually already been billed, but it may be recognized even if unbilled, as long as the revenue has been earned. Service revenue does not include any income from the shipment of goods, nor does it include any interest income.

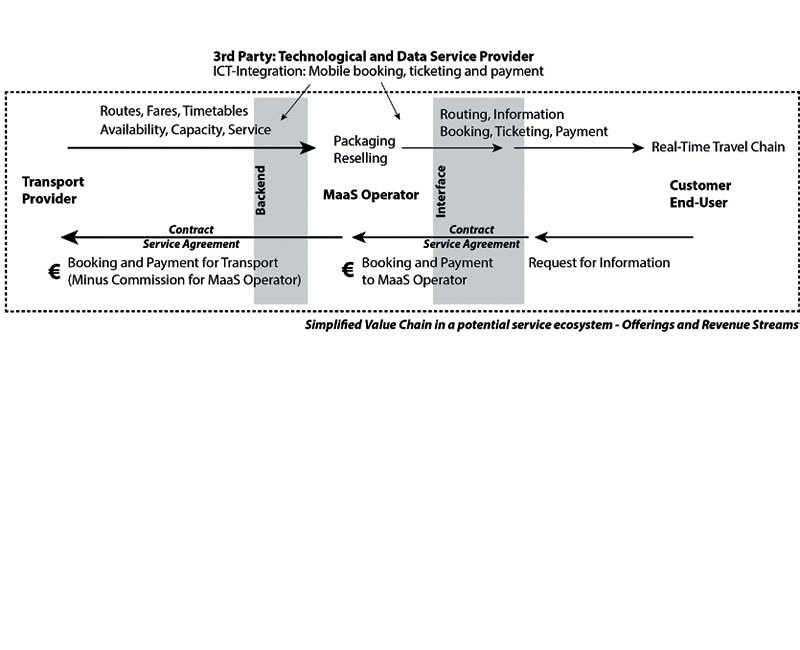

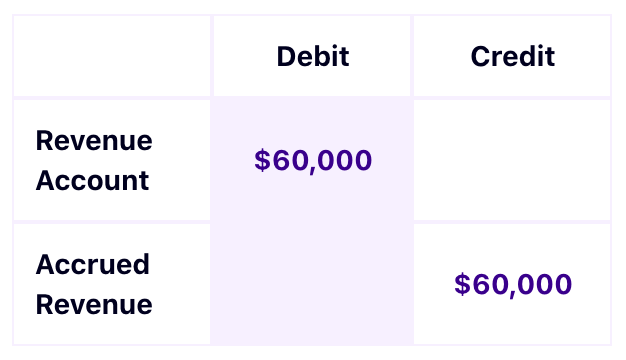

What is Accrued Revenue | How to Record It & Example | Tipalti Accrued revenue for product sales and services recognizes revenue and a current asset before the customer is billed and cash is collected for the revenue. Accrued income is a kind of accrued revenue that applies to interest income and dividend income. Accrued revenue accounting doesn't reflect cash flow, as does the cash method of accounting.

Unearned Revenue - Definition, Accounting Treatment, Example Unearned revenue, sometimes referred to as deferred revenue Deferred Revenue Deferred revenue is generated when a company receives payment for goods and/or services that it has not yet earned. In accrual accounting, , is payment received by a company from a customer for products or services that will be delivered at some point in the future.

Is service fees a revenue? - FindAnyAnswer.com Service Revenue is income a company receives for performing a requested activity. The charges for such revenue are recorded under the accrual method of accounting. This means all fees for services performed to date can be included in an income statement, even if not all the bills have been sent out to clients yet. Click to see full answer

Internal Revenue Bulletin: 2006-31 | Internal Revenue Service 31.7.2006 · The Internal Revenue Service and the Department of the Treasury are currently revising Form 656, Offer in Compromise, and developing regulations under section 7122 of the Internal Revenue Code to implement the amendments to section 7122 made by section 509 of the Tax Increase Prevention and Reconciliation Act of 2005 (“TIPRA”), Pub. L. No. 109-222.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

![Solved] Prepare the balance sheet for Damon Design Studio as ...](https://s3.amazonaws.com/si.question.images/image/images15/1335-B-F-A-A-T(16).png)

0 Response to "40 is service revenue an asset"

Post a Comment