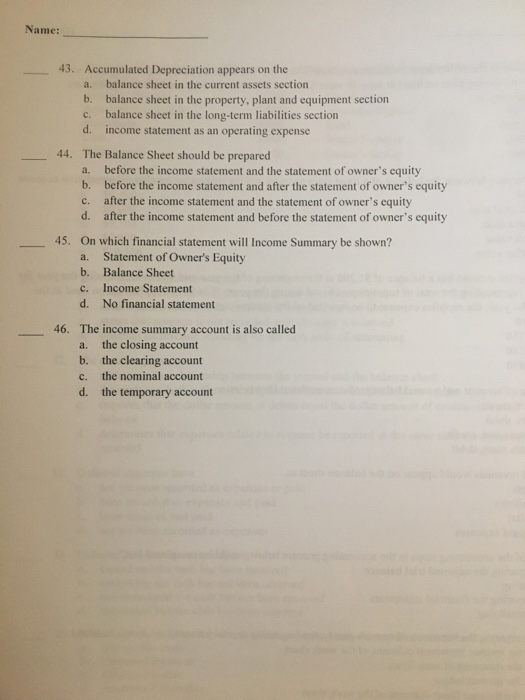

43 accumulated depreciation appears on the

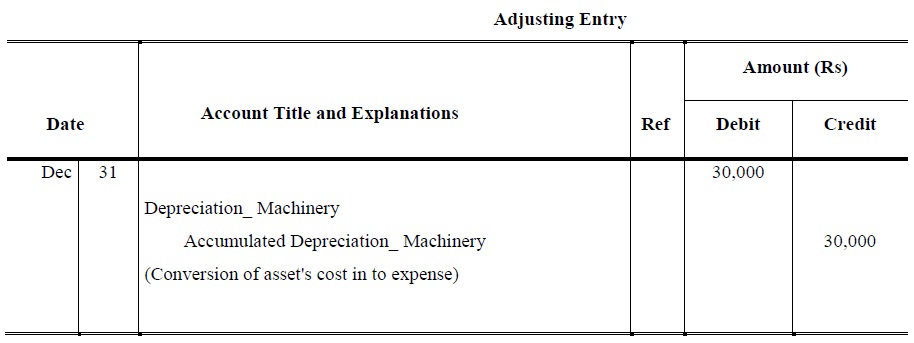

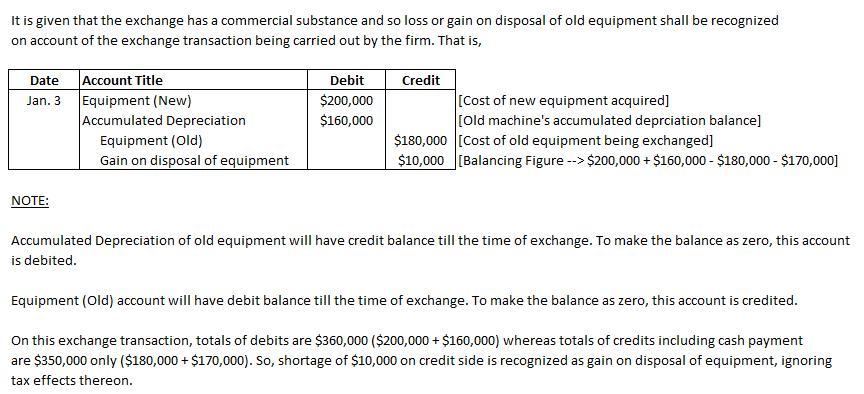

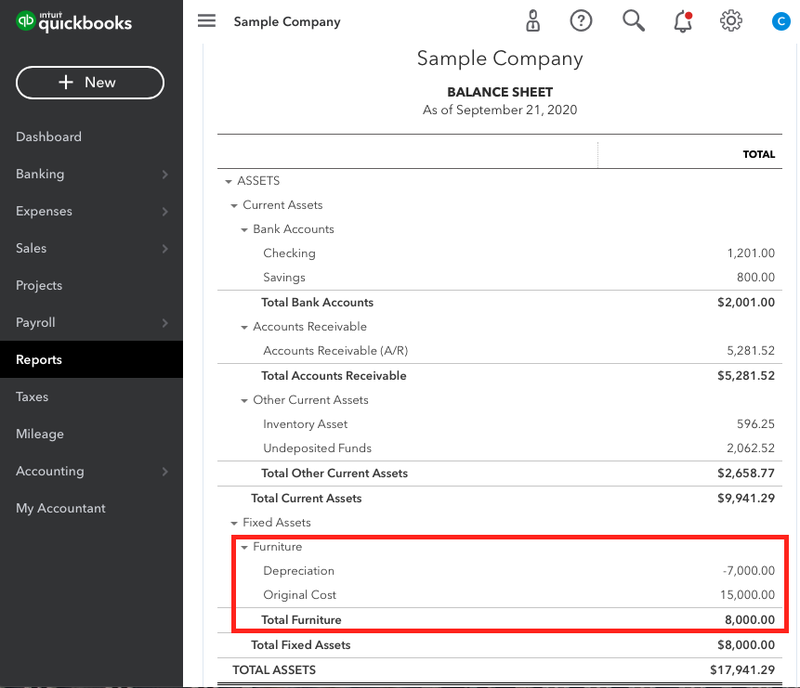

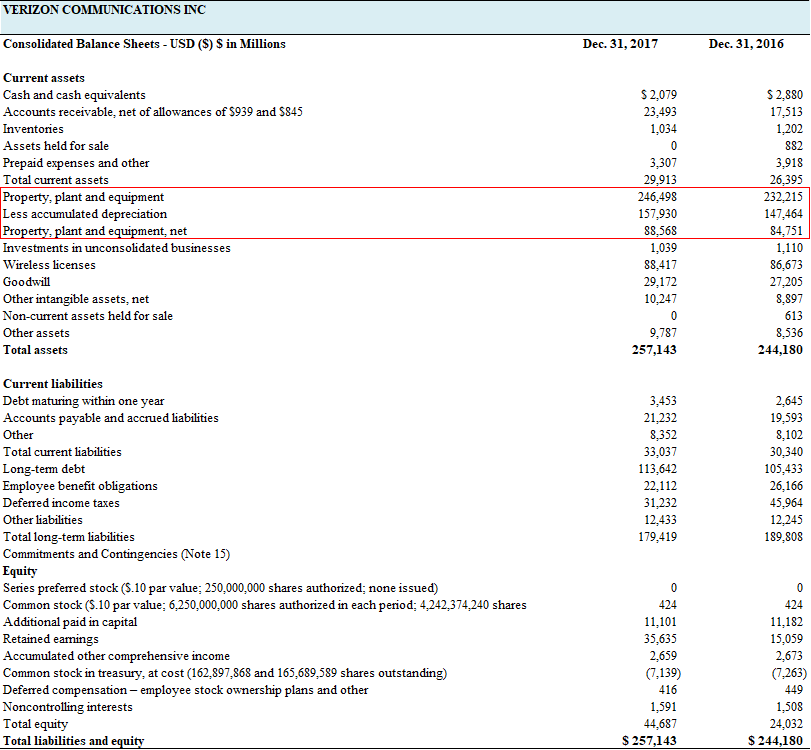

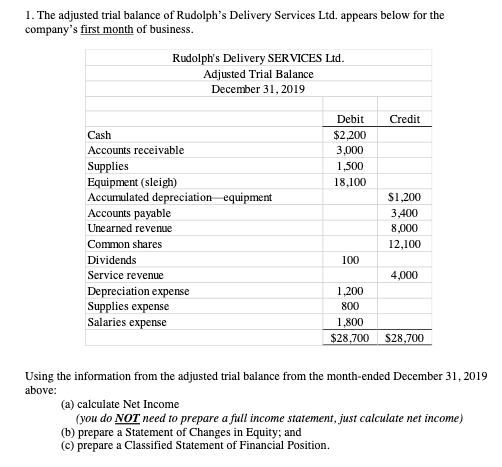

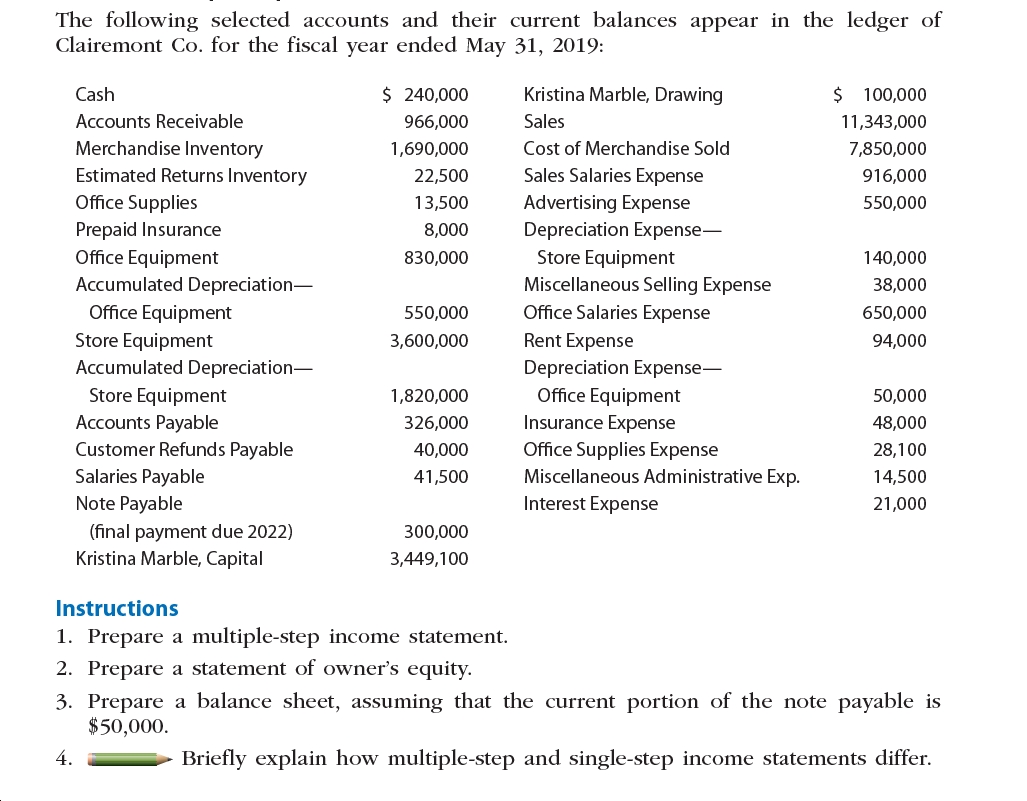

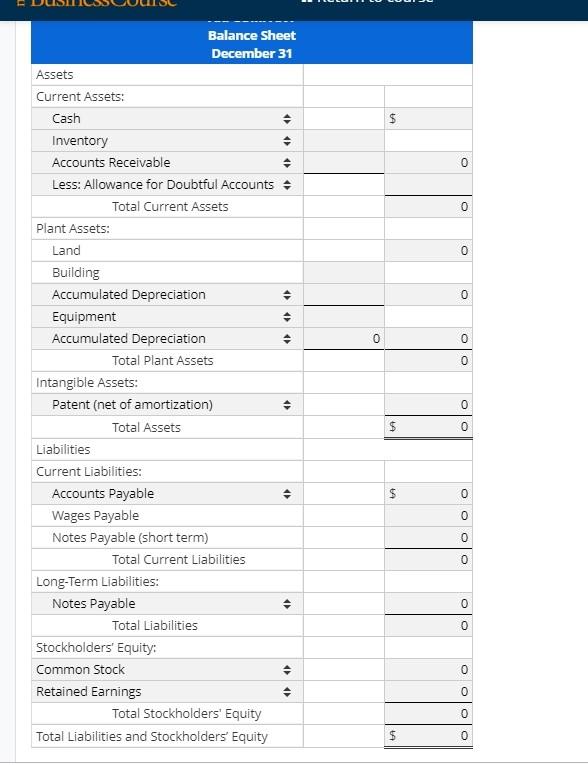

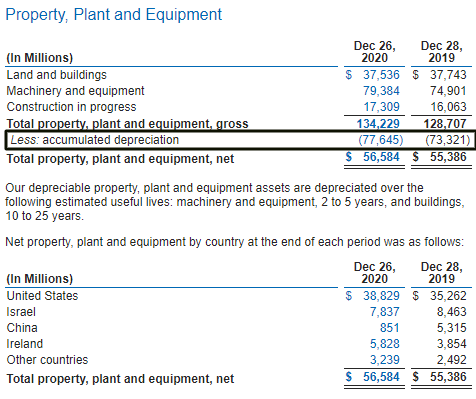

22 Accumulated Depreciation appears on the a balance sheet ... 22. Accumulated Depreciation appears on the: a. balance sheet in the current assets section b. balance sheet in the fixed assets section c. balance sheet in the long-term liabilities section d. income statement as an operating expense. b. balance sheet in the fixed assets section. ____ 23. Which one of the fixed asset accounts listed below will not have a related contra asset account? Accumulated Depreciation - Overview, How it Works, Example Accumulated depreciation is the total amount of depreciation expense allocated to a specific asset. PP&E (Property, Plant and Equipment) PP&E (Property, Plant, and Equipment) is one of the core non-current assets found on the balance sheet. PP&E is impacted by Capex, since the asset was put into use. It is a contra-asset account - a negative asset account that offsets the balance in the asset account it is normally associated with.

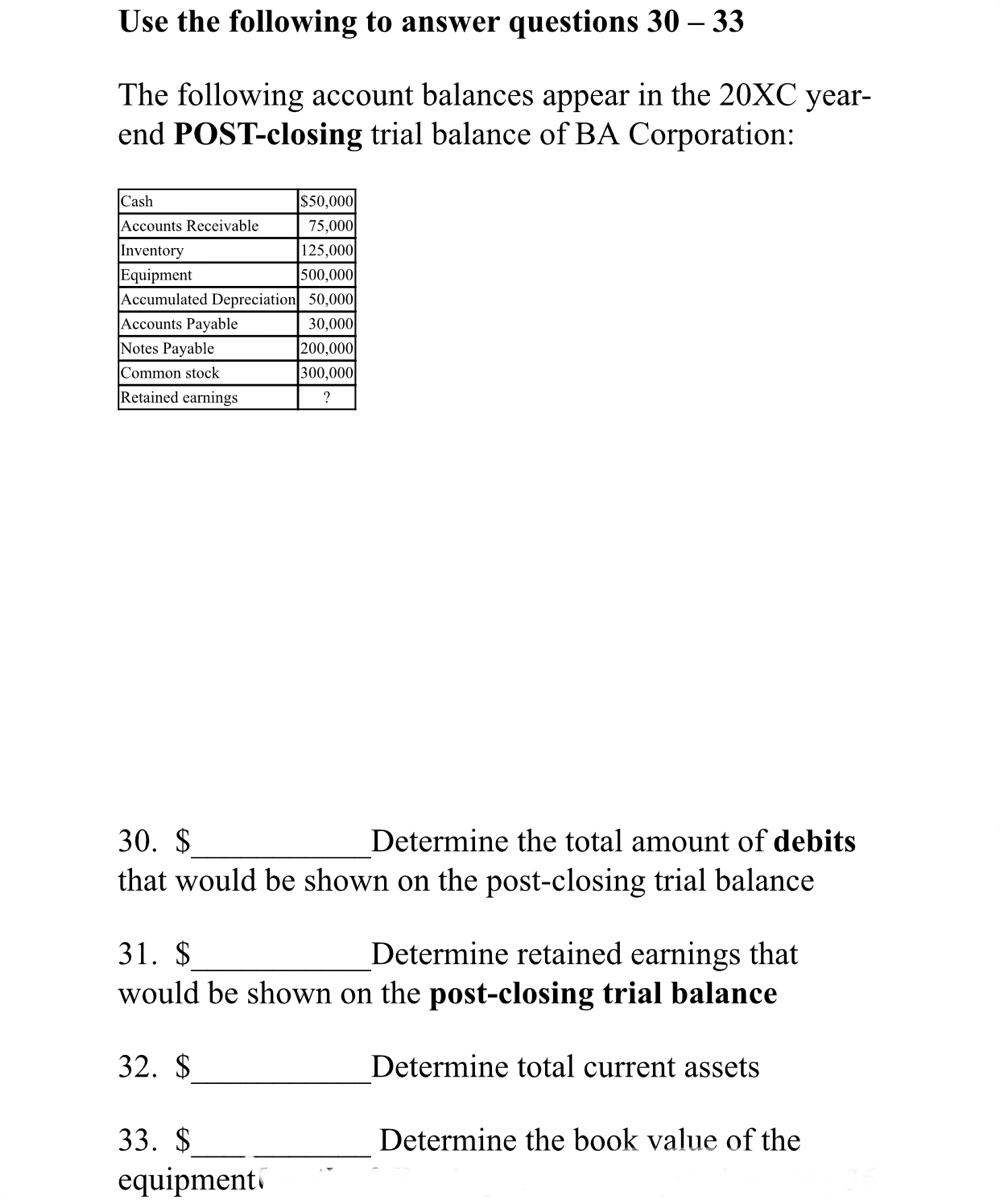

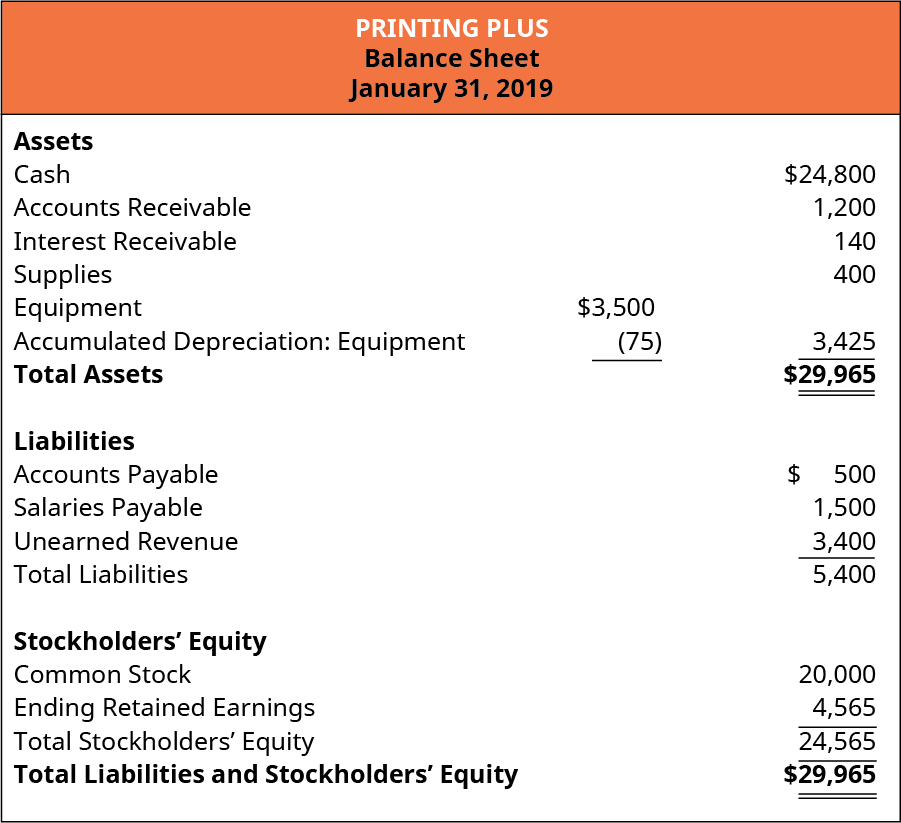

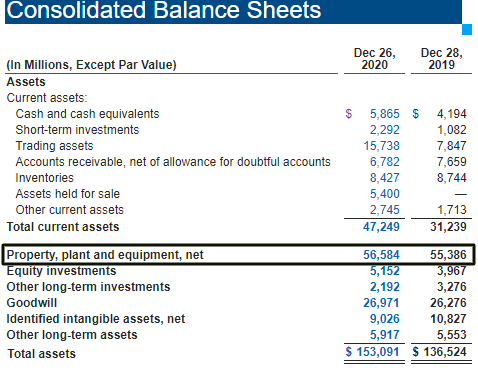

Does Accumulated Depreciation Go on a Balance Sheet ... Sep 26, 2017 · Accumulated depreciation does appear on the balance sheet, because it is a valuable financial measure for a company to consider. The balance sheet is a document that displays the details of a company's financial resources and obligations at any point in time. Because accumulated depreciation is a contra asset, it appears on a traditional ...

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-02-b230b73e49c3406ba7b944172f09a624.jpg)

Accumulated depreciation appears on the

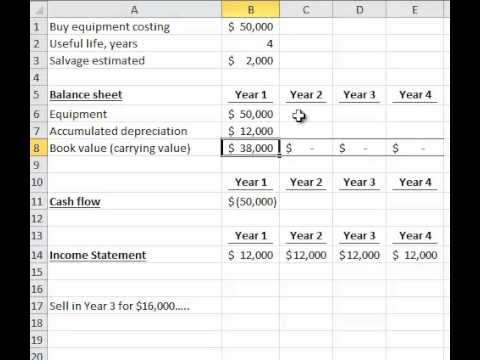

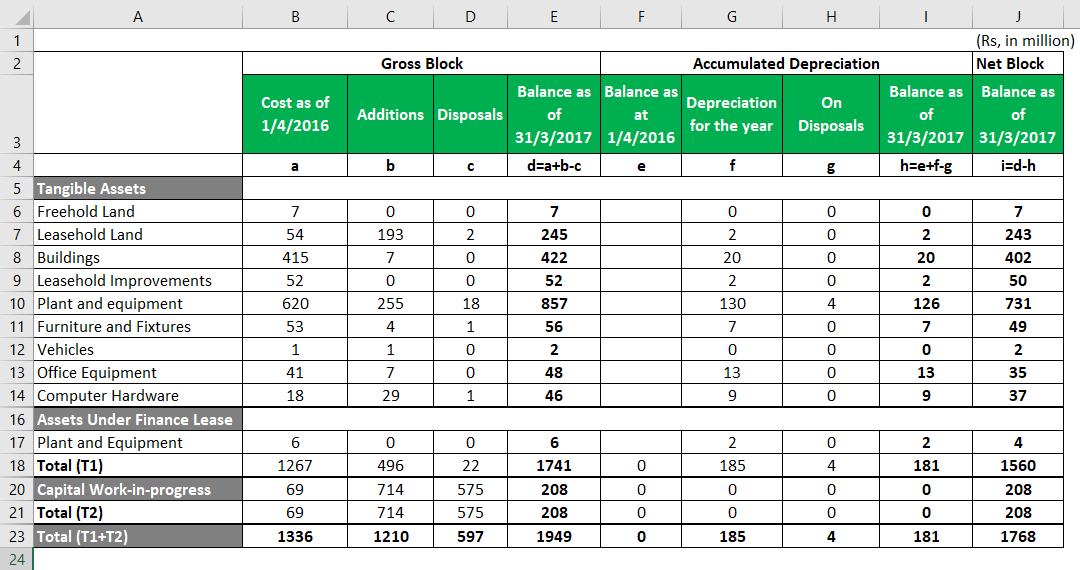

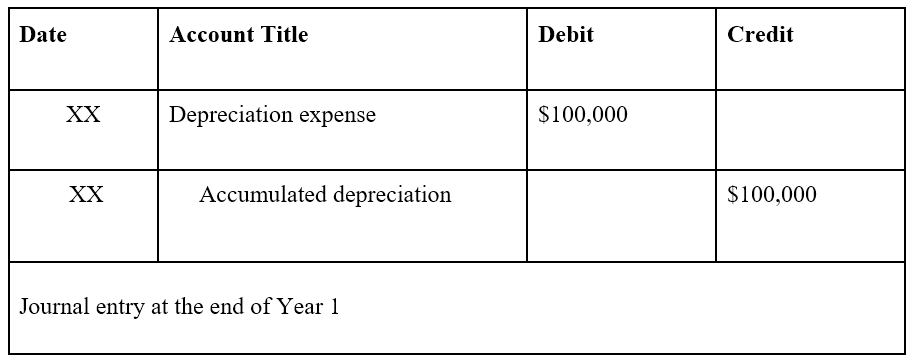

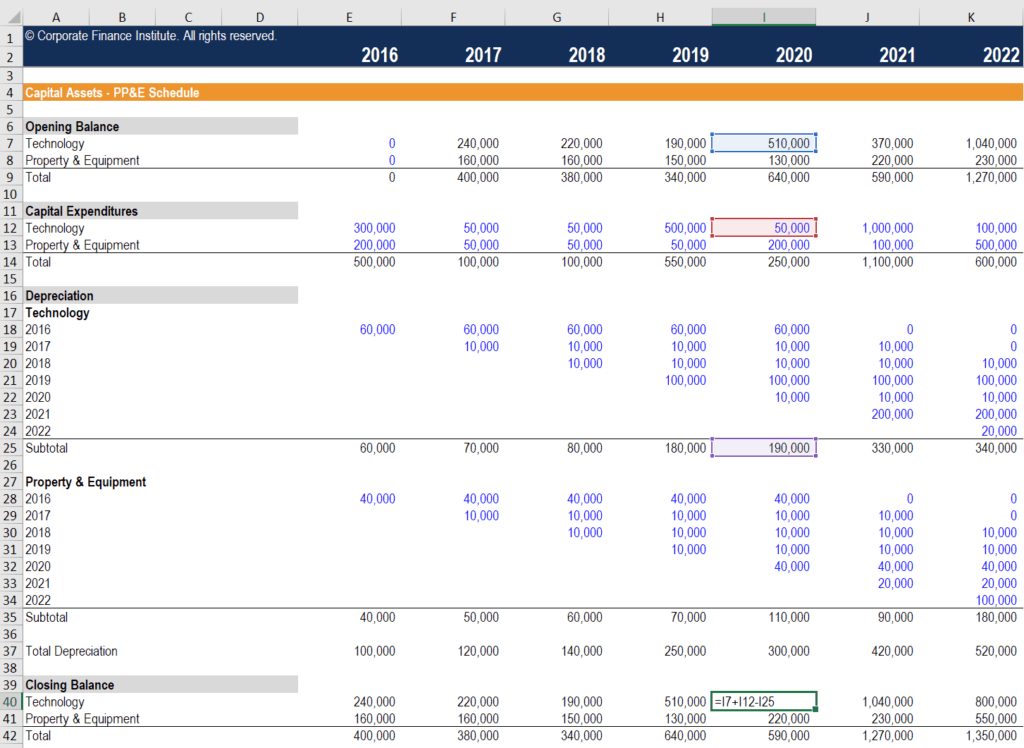

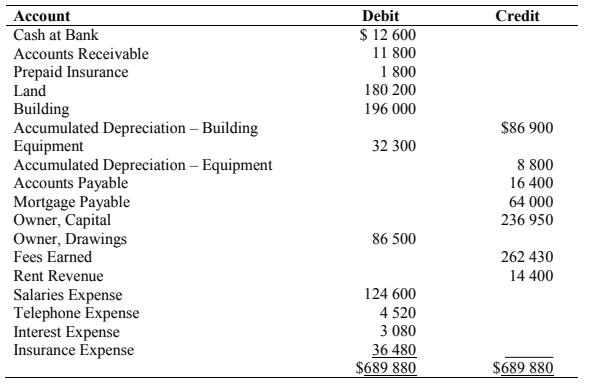

How is accumulated depreciation shown in trial balance? The accumulated depreciation is shown as a "credit item" in the trial balance. Accumulated depreciation is nothing but the sum total of depreciation charged until a specified date. Since in every reporting period, a part of a fixed asset is written off i.e depreciated such accumulated depreciation has a credit balance. Analyzing Accumulated Depreciation on the Balance Sheet Accumulated depreciation on the balance sheet serves an important role in in reflecting the actual current value of the assets held by a business. It represents the reduction of the original acquisition value of an asset as that asset loses value over time due to wear, tear, obsolescence, or any other factor. Key Takeaways Book Value vs. Carrying Value: What's the Difference? 12.06.2021 · However, most commonly, book value is the value of an asset as it appears on the balance sheet. This is calculated by subtracting the accumulated depreciation from …

Accumulated depreciation appears on the. Where Does Accumulated Depreciation Go on an Income ... Depreciation Expense appears on the income statement; Accumulated Depreciation appears on the balance sheet. For accounting purposes, the depreciation expense is debited, and the accumulated depreciation is credited. When recording depreciation in the general ledger, a company debits depreciation expense and credits accumulated depreciation. Accumulated Depreciation Appears On The | Corfepalmira Accumulated depreciation appears on the balance sheet in the property, plant, and equipment section. Accumulated Depreciation Template For tax purposes, the IRS requires businesses to depreciate most assets using the Modified Accelerated Cost Recovery System . Accounting is essential to the proper and efficient functioning of a business. Accumulated depreciation appears on the ____. Select one: a ... Accumulated depreciation appears on the balance sheet in the property, plant, and equipment section. Accumulated depreciation is a contra asset for... See full answer below. Accumulated depreciation appears on the Question 19 Accumulated Depreciation: appears in the asset section of a balance sheet. appears on the income statement. O is a liability on the balance sheet. is a contra-stockholders' equity item. Answer. Answer: Appears in the asset section of a balance sheet. Depreciation of an asset is accumulated in the accumulated depreciation account.

Accumulated Depreciation appears on the a. balance sheet ... Answers: 1 on a question: Accumulated Depreciation appears on the a. balance sheet in the property, plant, and equipment section b. balance sheet in the current assets section c. income statement as an operating expense d. balance sheet in the long-term liabilities section Accumulated depreciation appears on what balance sheet ... Accumulated depreciation appears on the balance sheet in the fixed assets section. It's important to keep all the financial aspects of a balance sheet in order so that they can be understood by ... Accumulated depreciation definition - AccountingTools Presentation of Accumulated Depreciation. Accumulated depreciation appears on the balance sheet as a reduction from the gross amount of fixed assets reported. It is usually reported as a single line item, but a more detailed balance sheet might list several accumulated depreciation accounts, one for each fixed asset type. What is Accumulated Depreciation? Definition, Formula ... Therefore, the accumulated depreciation account will be credited in the books of accounts of the company. Recording accumulated depreciation as a debit entry creates a wrong impression of the asset being a liability to a third party, which is not the case. These entries are designed to reflect the ongoing usage of fixed assets over time.

Is Accumulated Depreciation a Current Asset? It appears on the balance sheet as a reduction from the gross amount of fixed assets reported. Accumulated depreciation is not an asset because balances stored in the account are not something that will produce economic value to the business over multiple reporting periods. Accumulated depreciation actually represents the amount of economic ... Accumulated Depreciation Appears On The: study guides and ... Accumulated Depreciation appears on the A) balance sheet in the long-term liabilities section B) balance sheet in the property, plant, and equipment section A Notes receivable due in 390 days appear on the A) balance sheet in the noncurrent assets section B) balance sheet in the current assets section What Is the Accumulated Depreciation Formula? | GoCardless To record depreciation using this method, debit the depreciation expense and credit the accumulated depreciation value. Depreciation expenses appear on the income statement during the recording period, while accumulated depreciation shows up on the balance sheet under related capitalised assets. Where does Accumulated depreciation appear on financial ... Accumulated depreciation is recorded on the balance sheet. When depreciation expenses appear on an income statement, rather than reducing cash on the balance sheet, they are added to the accumulated depreciation account. Where does depreciation show up? income statement

Solved 12. Accumulated Depreciation appears on the A. a ... Accumulated Depreciation appears on the A. a balance sheet in the long term liabilities section B. a balance sheet in the property, plant, and equipment section C. income statement as an operating expense D.a balance sheet in the current assets section. 13. when preparing the statement of owners equity, the beginning capital balance can always be

Solved Accumulated Depreciation appears on the | Chegg.com Accumulated Depreciation appears on the a. balance sheet in the current assets section b. balance sheet in the property, plant, and equipment section c. income statement as an operating expense d. balance sheet in the long-term liabilities section.

What is Depreciation of Assets and How Does it Impact ... On selling the assets, the accumulated depreciation that appears on the balance sheet is reversed; which eventually removes assets from financial statements. Depreciation Vs. Amortization. Businesses regularly value their assets. Depreciation and Amortization are two methods that are used in the process.

Accumulated Depreciation on Your Business Balance Sheet Accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business, over time. The cost for each year you own the asset becomes a business expense for that year. This expense is tax-deductible, so it reduces your business taxable income for the year. 4 Two more terms that relate to long-term assets:

Answered: Multiple choice 1. Accumulated… | bartleby Multiple choice 1. Accumulated depreciation appears on the: A. Balance sheet debit column of a worksheet B. Income statement credit column of a worksheet C. Income statement debit column and balance sheet credit column of a worksheet D. Adjusted trial balance credit column and balance sheet credit column of a worksheet 2. Unearned fees appers on the: A. Adjusted trial balance debit column and income statement credit column of a worksheet B. Adjusted trial balance debit column and balance ...

Answered: 1.Accumulated Depreciation appears on… | bartleby 1.Accumulated Depreciation appears on the: a. Statement of Financial Statement b. Statement of Income c. Statement of changes in equity d. Statement of cash flows Which of the following appears on a post-closing trial balance? a. Insurance expense b.

Depreciation Expense vs. Accumulated Depreciation: What's ... Depreciation expense is reported on the income statement as any other normal business expense, while accumulated depreciation is a running total of depreciation expense reported on the balance...

Accumulated Depreciation appears on the a balance sheet b ... 24. Accumulated Depreciation appears on the: a. balance sheet in the current assets section b. balance sheet in the fixed assets section c. balance sheet in the long-term liabilities section d. income statement as an operating expense ANS: B DIF: 5 OBJ: 02. b. balance sheet in the fixed assets section. 25.

Applicability of IND AS - Indian Accounting Standards 28.07.2021 · The Ministry of Corporate Affairs (), in 2015, had notified the Companies (Indian Accounting Standards ()) Rules 2015, which stipulated the adoption and applicability of IND AS in a phased manner beginning from the Accounting period 2016-17.The MCA has since issued three Amendment Rules, one each in year 2016, 2017, and 2018 to amend the 2015 rules.

The difference between depreciation expense and ... Depreciation expense appears on the income statement, while accumulated depreciation appears on the balance sheet. The balance in the depreciation expense account is a debit, while the balance in the accumulated depreciation account is a credit.

Accounting Ch.3 Flashcards - Quizlet Accumulated Depreciation appears on the ? Balance Sheet, P.P. E Section. The Income Statement Should be prepared? ... credit Accumulated Depreciation $3,500. The difference between the cost of a fixed asset and its accumulated depreciation is known as its. book value.

Accumulated Depreciation and Depreciation Expense The accumulated depreciation account is a contra asset account on a company's balance sheet, meaning it has a credit balance. It appears on the balance sheet as a reduction from the gross amount of...

Book Value vs. Carrying Value: What's the Difference? 12.06.2021 · However, most commonly, book value is the value of an asset as it appears on the balance sheet. This is calculated by subtracting the accumulated depreciation from …

Analyzing Accumulated Depreciation on the Balance Sheet Accumulated depreciation on the balance sheet serves an important role in in reflecting the actual current value of the assets held by a business. It represents the reduction of the original acquisition value of an asset as that asset loses value over time due to wear, tear, obsolescence, or any other factor. Key Takeaways

How is accumulated depreciation shown in trial balance? The accumulated depreciation is shown as a "credit item" in the trial balance. Accumulated depreciation is nothing but the sum total of depreciation charged until a specified date. Since in every reporting period, a part of a fixed asset is written off i.e depreciated such accumulated depreciation has a credit balance.

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

![Solved] The three accounts shown below appear in the general ...](https://s3.amazonaws.com/si.question.images/images/question_images/1561/3/8/2/4085d10ce0882de01561365437817.jpg)

0 Response to "43 accumulated depreciation appears on the"

Post a Comment