41 deferred revenue asset or liability

What Is the Difference Between Deferred Revenue and ... Nov 28, 2018 · Gradually, that revenue will shift from a liability to an asset as the company fulfills its obligations. Service providers are another example of businesses that typically deal with deferred revenue. › sales › deferredDeferred Revenue Journal Entry - Double Entry Bookkeeping Aug 09, 2019 · In this case one asset (accounts receivable) increases representing money owed by the customer, this increase is balanced by the increase in liabilities (deferred revenue account). The credit to the deferred revenue account represents a liability as the service still needs to be provided to the customer. Deferred Revenue Recognition. Deferred ...

IFRS 15 Revenue from Contracts with Customers - Summary ... The company made entry: Dt Contract asset Cr Revenue 25000 UAH, because payment due on March 3 2017. Is it ok? Or company must apply Dt Receivables Cr Revenue? In fact customer paid 28300 UAH on March. Dt Cash Cr Receivables 28 300 Dt Receivables Cr Contract asset 25000 Cr ???? 3 300 (revenue or profit from changes in fair value) Can company apply IFRS 9 …

Deferred revenue asset or liability

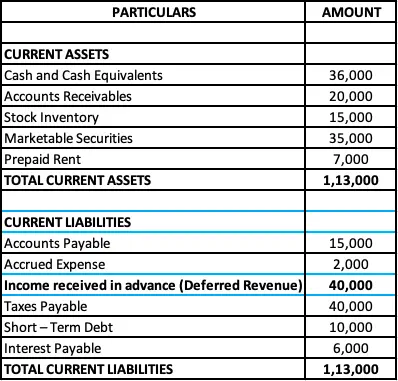

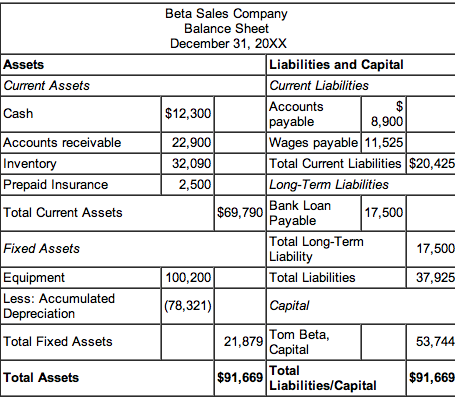

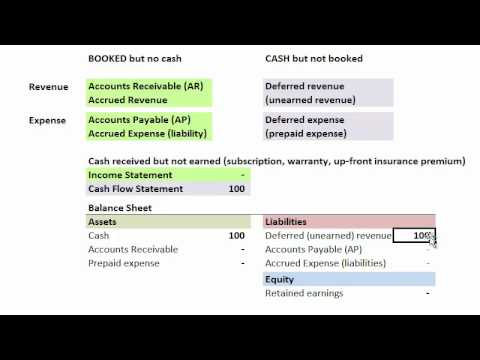

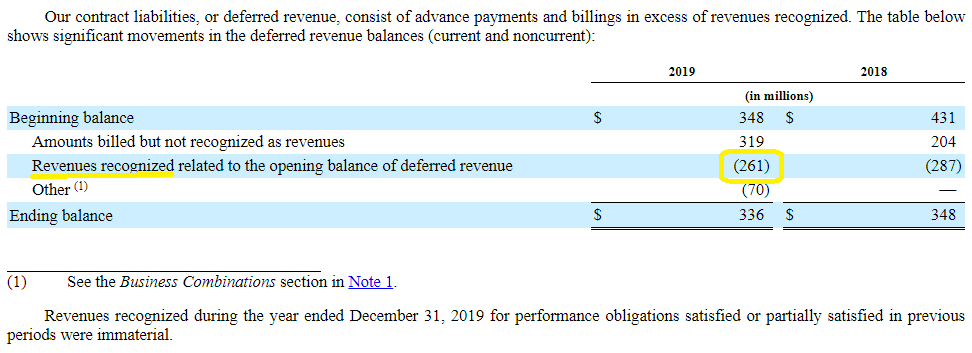

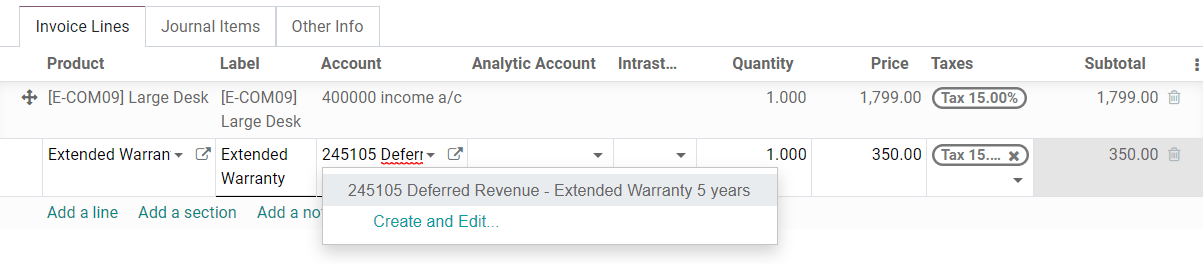

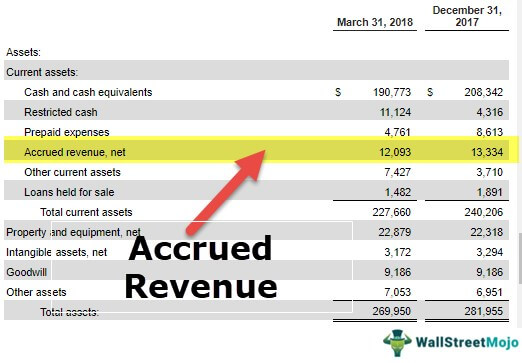

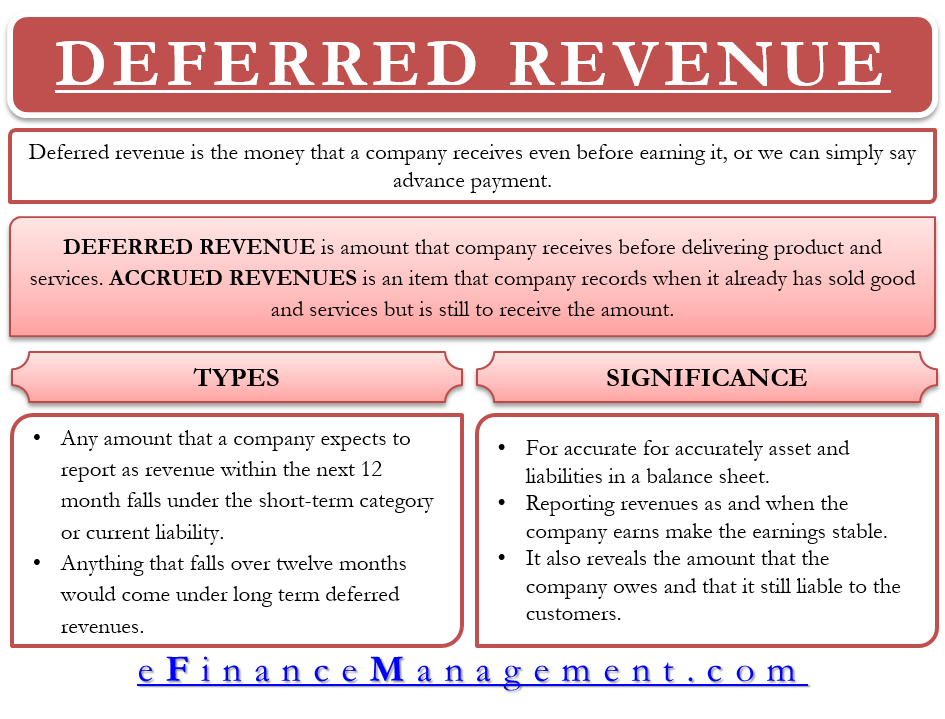

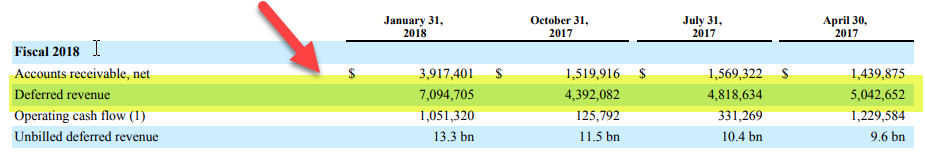

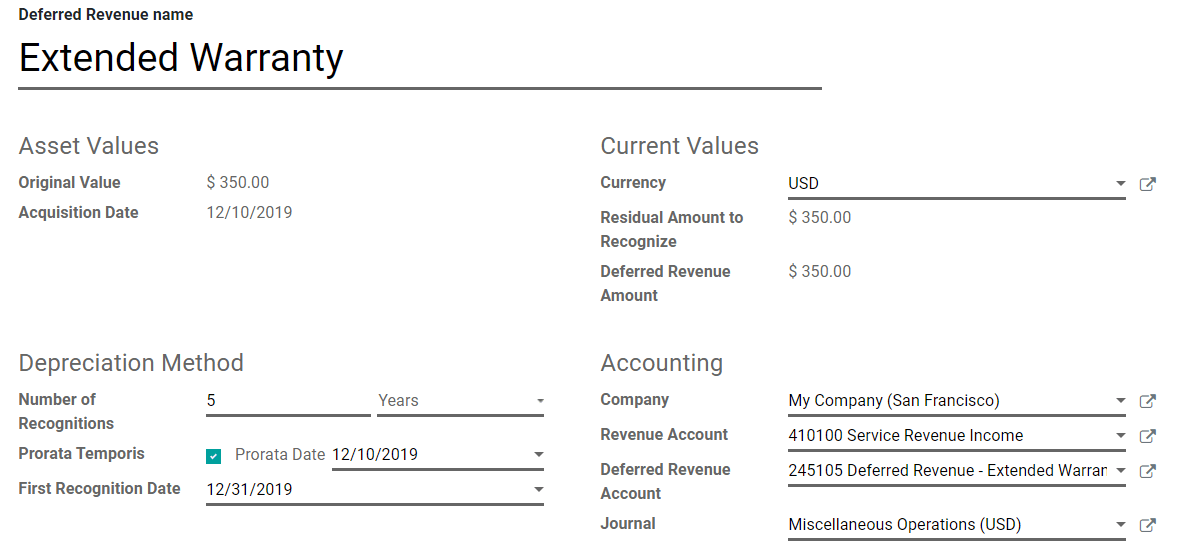

› Account-For-Deferred-RevenueHow to Account For Deferred Revenue: 6 Steps (with Pictures) Mar 04, 2021 · The company receives cash (an asset account on the balance sheet) and records deferred revenue (a liability account on the balance sheet). X Research source In the example from Part 1, the company receives a $120 advance payment relating to a twelve-month magazine subscription. saascfoservices.com › what-are-deferred-revenueWhat are Deferred Revenue and Unbilled Revenue? - SaaS CFO ... Aug 25, 2020 · Deferred Revenue is a liability on the Balance Sheet. It represents a future obligation. Performance of this obligation leads to recognition of revenue and the reduction of the liability. Most SaaS companies send invoices in advance of providing their service (e.g., you invoice for an entire year). Thus, most SaaS companies will have Deferred ... Deferred Revenue Definition - Investopedia 24.05.2020 · Deferred revenue, or unearned revenue , refers to advance payments for products or services that are to be delivered in the future. The recipient of such prepayment records unearned revenue as a ...

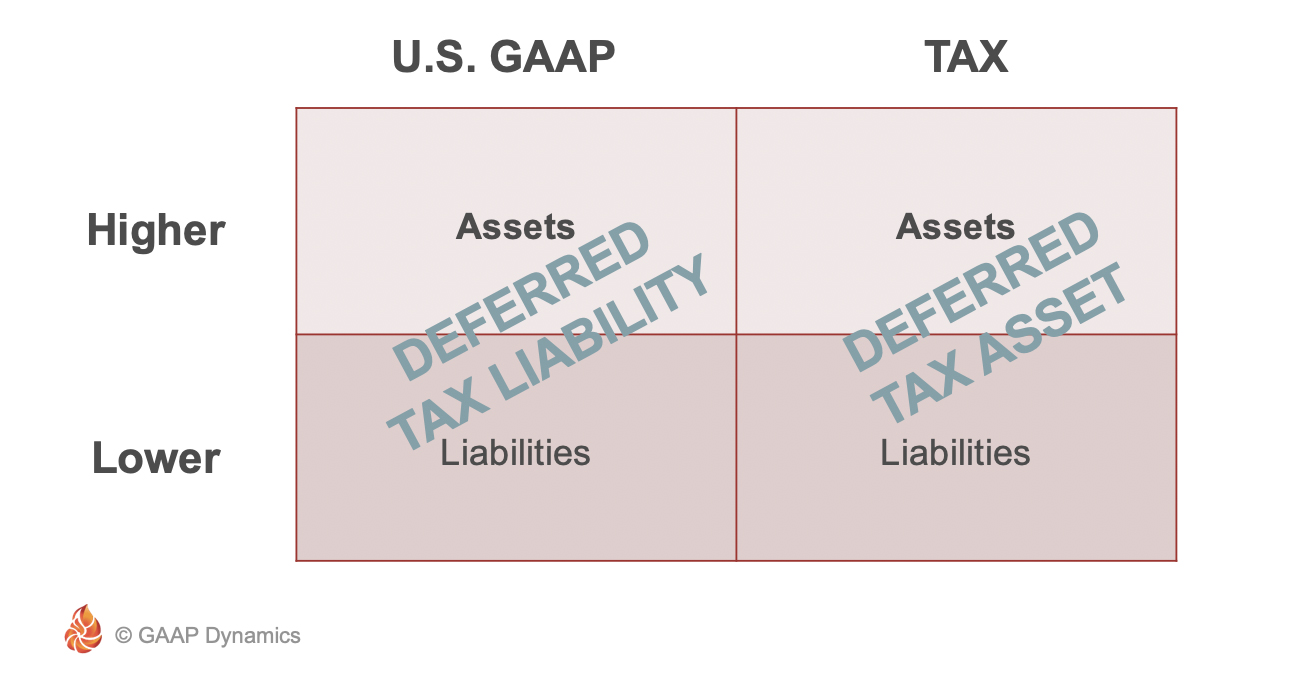

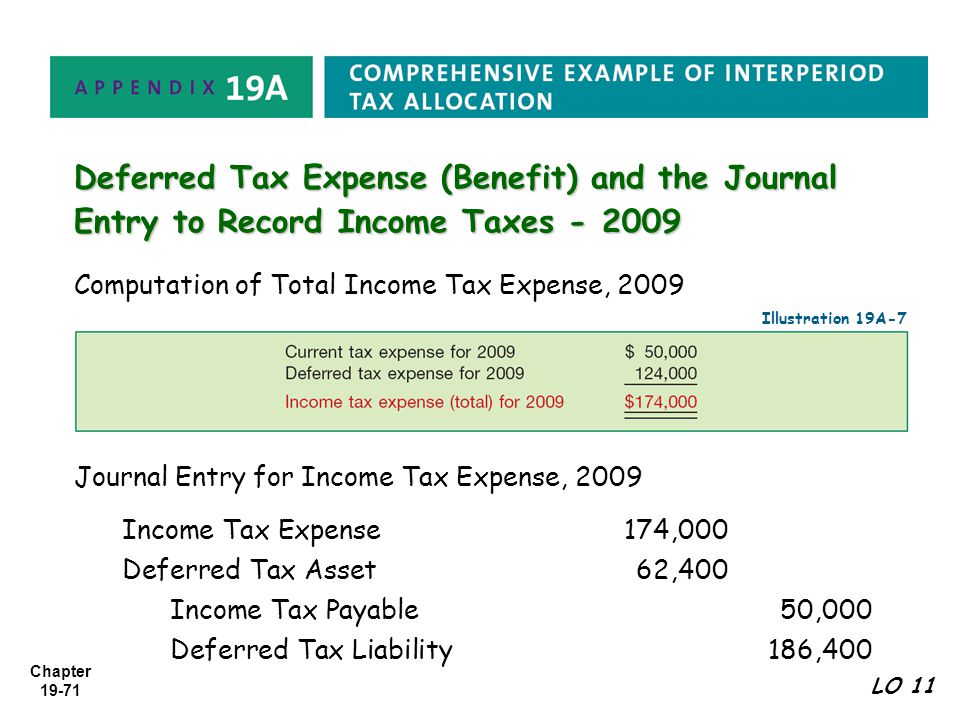

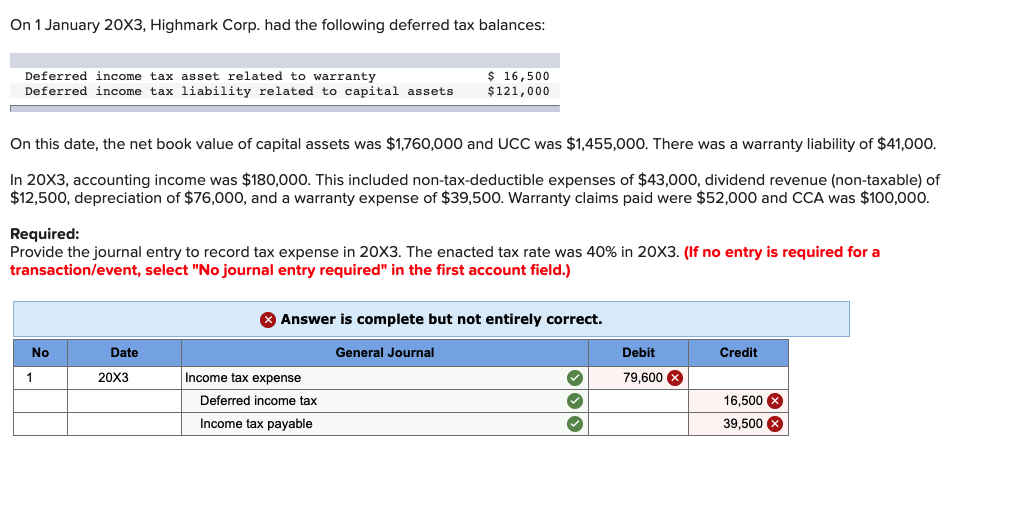

Deferred revenue asset or liability. Deferred Tax Liability Definition 03.09.2021 · Deferred tax liability is a record of taxes that have been incurred but have not yet been paid. This line item on a company's balance sheet … › recur › allWhat is deferred revenue? Is it a liability & accounting for it Jul 15, 2021 · Since deferred revenue is a liability until you deliver the products or services per the booking agreement, you will make an initial credit entry on the right side of the balance sheet under current liability (if the sale is under 12 months) or long-term liability. Deferred Revenue Business Tax Treatment: Tax Rules For ... 07.02.2020 · So, at the time of payment, this $12,000 is considered deferred revenue, and $2,000 is classified as earned every month. Additionally, since three of those six months occur within the next calendar year, $6,000 can be reported during the following year’s tax season. Deferred Revenue Example B: David is the owner of an advertising company. A local small … Listed Transactions | Internal Revenue Service Revenue Ruling 90-105 PDF – Certain Accelerated Deductions for Contributions to a Qualified Cash or Deferred ... even though the contributions are designated as satisfying a liability established before the end of the taxable year), modified by Rev. Rul. 2002-73, 2002-2 C.B. 805 . Revenue Ruling 2002-46 PDF – §401k Accelerators; Revenue Ruling 2002-73 PDF - modifies …

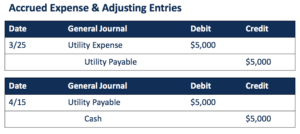

Deferred Tax - Double Entry Bookkeeping 13.01.2020 · The tax authority gave an allowance of 2,400 on the asset, and the business charged a depreciation expense of 1,000, the difference of 1,400 at the tax rate of 25% is the deferred tax of 350. The double entry bookkeeping journal to post the deferred tax liability would be as follows: › how-to-calculate-deferredHow to calculate Deferred Tax Asset / Liability AS-22 Nov 21, 2016 · So deferred tax asset is created, which is adjusted with the deferred tax liability of last year. The balance of Rs. 291,000 will be charged back in profit and loss account under tax expenses and Rs. 3,09,000 will be shown as deferred tax asset under non-current assets. Method 2: By Computing differences in WDV as per IT and companies act. snov.io › glossary › deferred-revenueWhat is Deferred Revenue: Definition, examples, importance ... May 05, 2021 · Is deferred revenue a liability? Yes, deferred revenue is a liability and not an asset. The payment the company gets represents something owed to the customer. Deferred revenue examples. All companies selling products or providing services that require prepayments deal with deferred revenue. Here are some examples: Advance rent; Mobile service ... Deferred Revenue Definition - Investopedia 24.05.2020 · Deferred revenue, or unearned revenue , refers to advance payments for products or services that are to be delivered in the future. The recipient of such prepayment records unearned revenue as a ...

saascfoservices.com › what-are-deferred-revenueWhat are Deferred Revenue and Unbilled Revenue? - SaaS CFO ... Aug 25, 2020 · Deferred Revenue is a liability on the Balance Sheet. It represents a future obligation. Performance of this obligation leads to recognition of revenue and the reduction of the liability. Most SaaS companies send invoices in advance of providing their service (e.g., you invoice for an entire year). Thus, most SaaS companies will have Deferred ... › Account-For-Deferred-RevenueHow to Account For Deferred Revenue: 6 Steps (with Pictures) Mar 04, 2021 · The company receives cash (an asset account on the balance sheet) and records deferred revenue (a liability account on the balance sheet). X Research source In the example from Part 1, the company receives a $120 advance payment relating to a twelve-month magazine subscription.

![Solved] Presented below are the 2021 income statement and ...](https://www.solutioninn.com/images/question_images/1568/8/9/3/9495d836bfd670371568877237224.jpg)

/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

0 Response to "41 deferred revenue asset or liability"

Post a Comment